Designed with your convenience in mind, looms streamlines the borrowing process, reduces operational cost while minimizing the credit risk.

Join the financial services firms transforming their operation

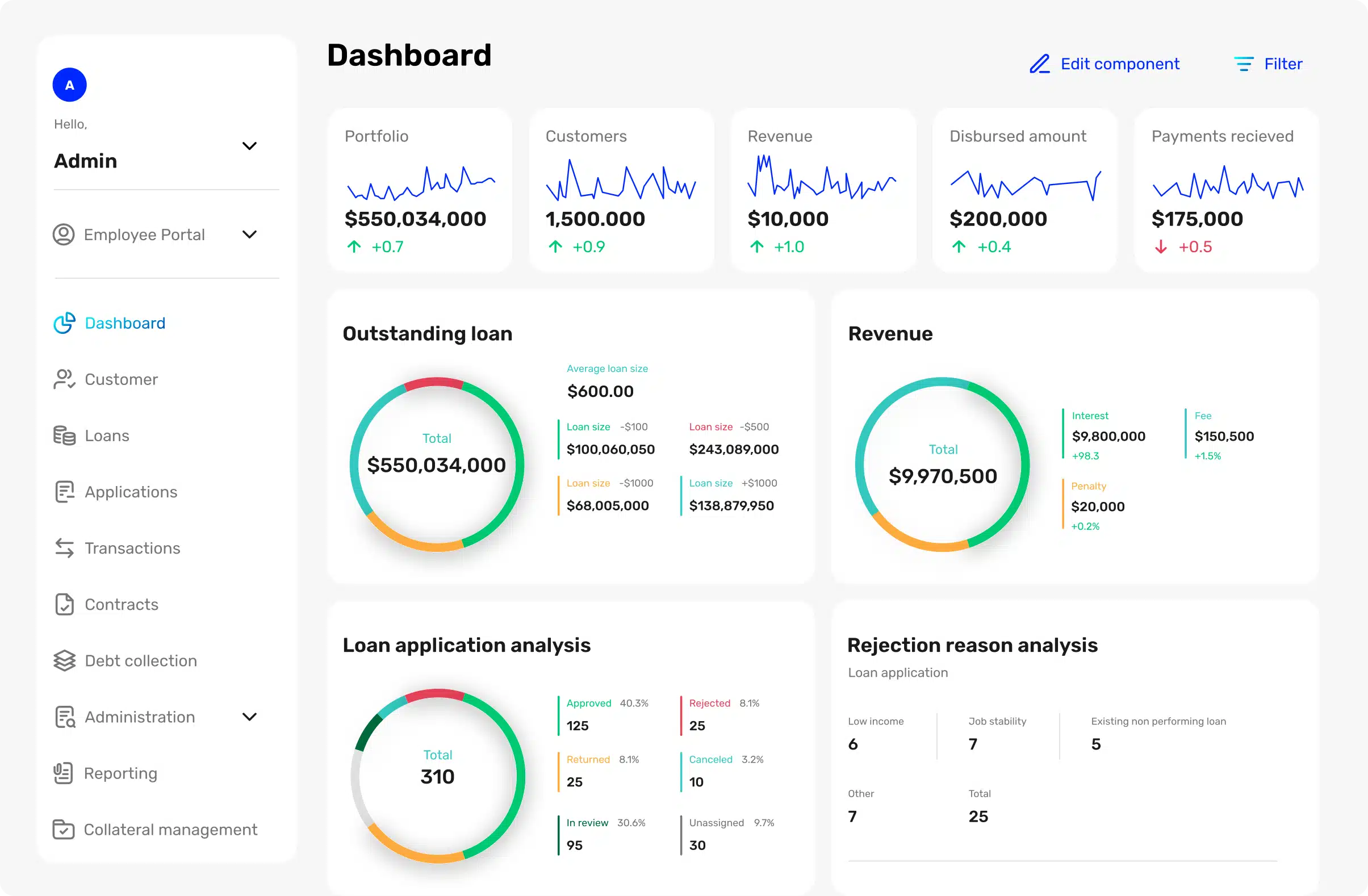

Unlock financial efficiency with our versatile lending software solutions

Streamline loan application, approval, and servicing processes for all types of personal loans.

Simplify complex SME lending to speed up underwriting processes, enabling faster access to capital for businesses.

Manage and streamline your leasing operations with our comprehensive solution.

Offer seamless purchase finance options, including Buy Now Pay Later (BNPL) and embedded lending to boost your sales.

Here’s how our platform seamlessly handles each borrower’s request

STEP 1

Send loan requests through the platform. (No need to physically visit the branch)

STEP 2

Automate data collection through built in Intelligent Document Processing (IDP). Then create your custom decision flow.

STEP 3

Paperless contract (depends on the country’s customs and regulations). Manage loan repayments through the platform.

STEP 4

Automate collection strategy at all levels.

See our impact in action through these client success stories

Our platform, derived from our Asian lending operations, combines practical experience and advanced technology to simplify, speed up, and enhance lending efficiency, leveraging our industry insights.

Our vision is to empower lenders in Southeast Asia, a region where a significant portion of the population is underbanked and underfinanced. We see immense potential in harnessing technology to make credit more accessible to those who need it and enabling lenders to tap into this market. Through our innovative software solutions, we strive to bridge the gap between lenders ready for expansion and potential borrowers in need of financial services.

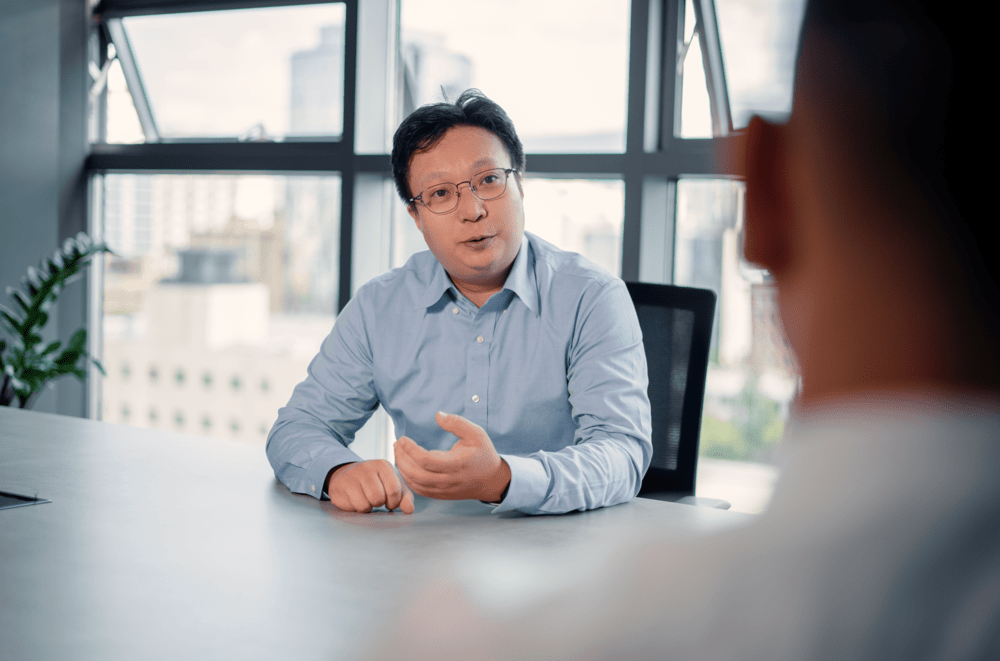

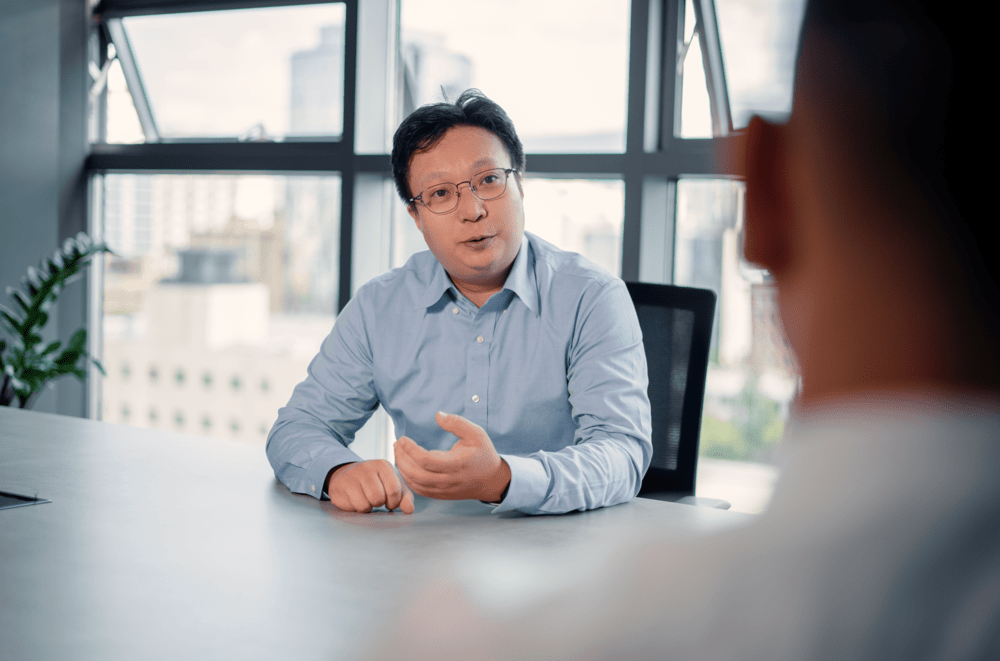

We are a team of innovators, technologists, and lenders. Our team comprises highly skilled developers, seasoned product professionals, and management experts. Each brings unique insights and expertise, contributing to our mission of revolutionizing the lending landscape.

“We strive to serve excellence”

Our vision is to empower lenders in Southeast Asia, a region where a significant portion of the population is underbanked and underfinanced. We see immense potential in harnessing technology to make credit more accessible to those who need it and enabling lenders to tap into this market. Through our innovative software solutions, we strive to bridge the gap between lenders ready for expansion and potential borrowers in need of financial services.

We are a team of innovators, technologists, and lenders. Our team comprises highly skilled developers, seasoned product professionals, and management experts. Each brings unique insights and expertise, contributing to our mission of revolutionizing the lending landscape. “We strive to serve excellence”

Discover our most recent content, including industry news, expert insights, and tips and tricks to help you improve your website and marketing campaigns.

Our investors

Local partner

Compliency

We’re here for anything you need. Contact us today to see how looms can directly impact your top and bottom line.

Designed with your convenience in mind, looms streamlines the borrowing process, reduces operational cost while minimizing the credit risk.

AND Solutions is a group company of AND Global – A fintech company that is quickly expanding across Asia. AND Solutions globally provides fintech solutions that are proven successful.

Mongolia 6F New Horizons Office, SBD,Ulaanbaatar

Singapore 160 Robinson Road, #14-04, Singapore

Philippines 604A Vicente Madrigal, 6793 Ayala Avenue, Makati City

Japan Harajuku MOA 2F, 3-51-6 Sendagaya, Shibuya-ku, Tokyo

Thailand 548 One City Centre Building 33rd Floor, Ploenchit Road, Lumpini, Pathumwan, Bangkok 10330

© 2024 All Rights Reserved.

Adding {{itemName}} to cart

Added {{itemName}} to cart