The world of lending can seem complex, with various processes and systems in play. But for both lenders and borrowers, two key systems streamline the loan journey: Loan Origination Systems (LOS) and Loan Management Systems (LMS). Let’s delve into what each system does and how they contribute to a smoother lending experience.

The Loan Lifecycle: From Inquiry to Closure

Imagine the loan process as a journey. It starts with a borrower’s initial inquiry, progresses through application, underwriting, and approval stages, and finally reaches loan servicing and repayment. LOS and LMS play crucial roles in different phases of this lifecycle.

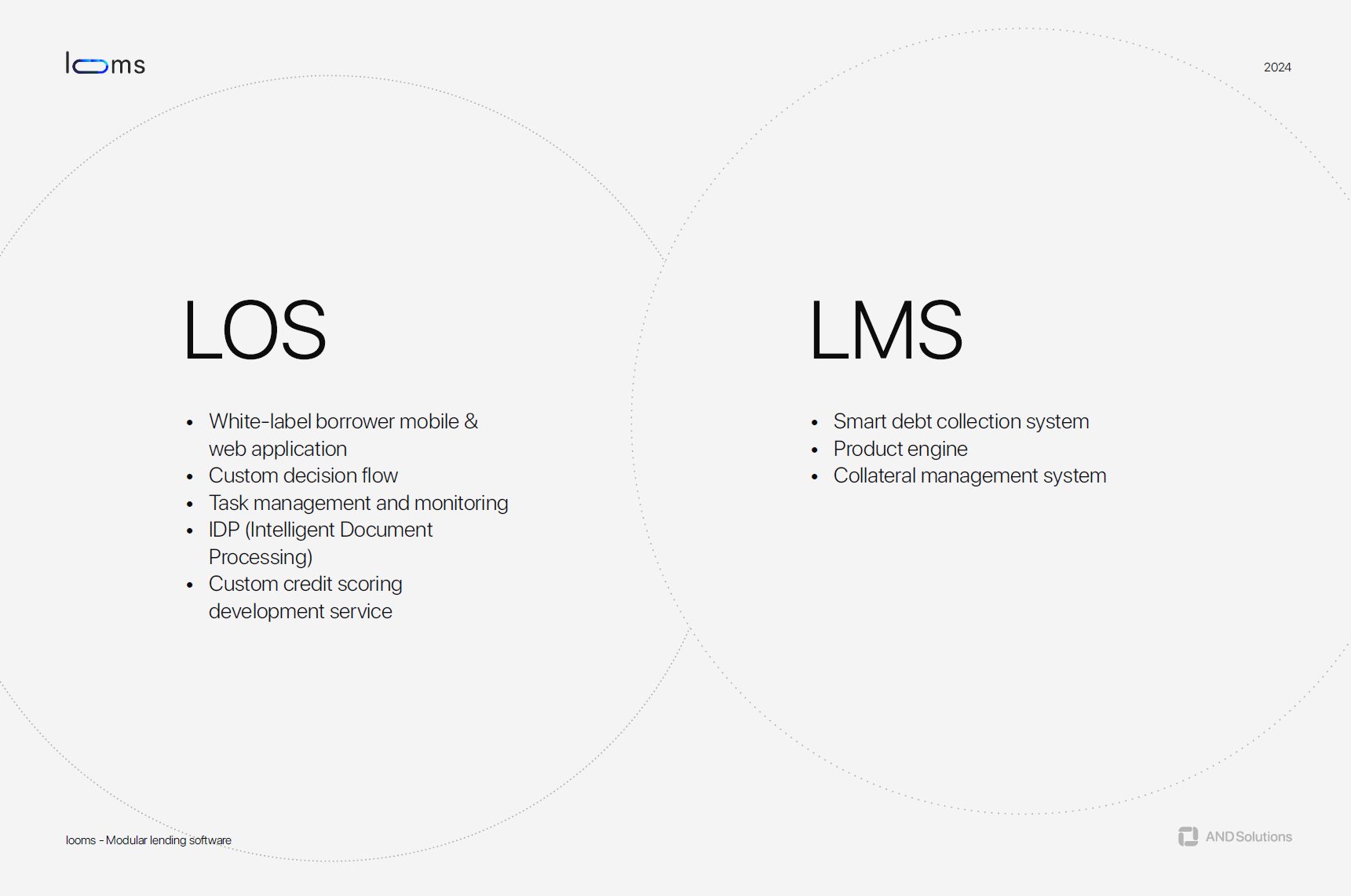

LOS: The Origination Powerhouse

Think of LOS as the launchpad for your loan journey. It automates and streamlines the initial stages, including:

- Application Processing: LOS efficiently captures borrower information, automates data entry, and facilitates online applications.

- Credit Check Integration: LOS seamlessly integrates with credit bureaus to obtain credit reports and scores, expediting the approval process.

- Document Management: LOS helps organize and manage all loan-related documents electronically, ensuring everything is readily available.

- Fraud Detection: Advanced LOS solutions incorporate fraud detection tools to identify suspicious activity and protect lenders from financial risks.

- Regulatory Compliance: LOS helps ensure loan applications comply with all relevant regulations, reducing the risk of errors or violations.

LOS functionality goes beyond automation. It can be customized to handle different loan types, such as auto loans, mortgages, or personal loans. Imagine an auto loan application process – LOS can streamline tasks like integrating with vehicle valuation services or managing vehicle registration documents.

LMS: Managing Loans Through Repayment

Once a loan is approved and funded, LMS takes over. It acts as the central hub for managing loan servicing and repayment throughout the loan term. Key features of LMS include:

- Automated Payment Processing: LMS automates various payment methods, from recurring debit/credit card charges to electronic check processing.

- Delinquency Management: LMS identifies and tracks late payments, allowing for timely intervention and communication with borrowers.

- Customer Portal Access: Many LMS solutions offer borrower portals for online payments, account statement viewing, and communication with loan servicers.

- Reporting and Analytics: LMS generates comprehensive reports on loan performance, delinquency rates, and customer behavior, providing valuable insights for lenders.

Integration and Scalability: A Winning Combination

For a seamless lending experience, it’s crucial to integrate LOS and LMS. This ensures a smooth transition from loan origination to servicing, with all borrower information readily available throughout the lifecycle. Additionally, opting for scalable solutions allows your lending business to grow without system limitations.

Benefits for Everyone: Lenders, Borrowers, and Investors

LOS and LMS offer significant advantages for various stakeholders:

- Lenders: Experience increased efficiency, reduced costs, faster loan approvals, improved decision-making through data analysis, and better risk management.

- Borrowers: Benefit from faster application processing, a more streamlined experience, and potentially faster approvals. Additionally, LMS portals can provide convenient online access to manage their loans.

- Investors: Gain peace of mind with reduced risk through compliance and fraud detection tools offered by LOS. LMS data allows for better portfolio management and risk assessment.

The Future of Loan Systems: A Glimpse Ahead

The world of loan systems is constantly evolving. Emerging trends in lending include:

- Cloud-Based Solutions: Cloud technology offers increased accessibility, scalability, and cost-effectiveness for LOS and LMS.

- AI-Powered Credit Scoring: Artificial intelligence can analyze vast datasets to offer faster and more accurate credit scoring for loan approvals.

- Blockchain Integration: Blockchain technology holds promise for secure and transparent loan servicing and data management.

Ready to Streamline Your Lending Journey?

By understanding LOS and LMS and their functionalities, you’re well on your way to a smoother and more efficient lending experience. Book a free consultation with our experts to dive deeper into more streamlined lending journey.